There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

In our earlier posts, we discussed the open account, advance payment and documentary collections methods. None of those methods gave any kind of guarantee of payment to the exporter.

In a letter of credit transaction, not only the banks are involved in document handling and collection of payments, but also undertakes to pay the exporter provided certain conditions are met.

Want to learn more about International Trade Finance?

Discover all the essentials for a career in trade finance with this comprehensive 5-in-1 course package

View Details

Letter of Credit is a set of mutually agreed set of conditions of a trade between the exporter and the importer and agreed by the issuing bank. It says about what goods to be send, by which mode of transport to be send, by which date the goods have to be send etc. It includes various other terms and conditions which the seller has to accurately follow.

Now, here banks are no longer just agents. The LC issuing bank gives a irrevocable undertaking that provided all the conditions mentioned in the LC is followed accurately by the exporter, even if under any circumstance the importer fails to pay for the goods, the LC issuing bank will pay the exporter.

Thus, the exporter gets a guarantee of payment if he fulfills all criteria in LC, and, the importer is happy because if the conditions in LC are really fulfilled by the exporter, then he can ‘assume’ that he is getting the right quality/quantity of goods that he wanted.

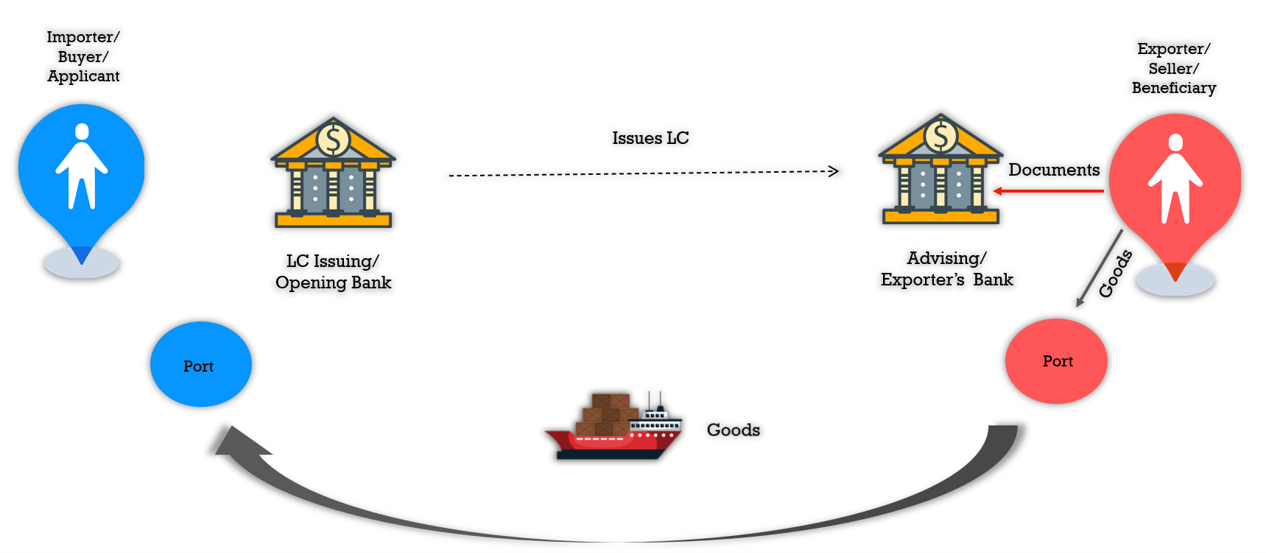

In the intricate landscape of international trade, understanding the nuances of a Letter of Credit (LC) transaction is pivotal. Let's embark on a journey through the process flow, unraveling the roles of key parties involved in this financial instrument.

Parties Involved: Buyer, Seller, and Banks

At the core of an LC transaction are the buyer and seller, each navigating through their banks and the ports or locations involved in dispatching and receiving goods. The initial step involves mutual agreement on a contract, detailing goods, transport mode, and a crucial decision on payment terms: immediate payment through 'Documents Against Payment' (D/P) or deferred payment through 'Documents Against Acceptance' (D/A).

LC Issuance: The Buyer's Initiative

The buyer, referred to as the applicant, approaches their bank, commonly known as the LC issuing or opening bank, to request the issuance of an LC. This formal document is then transmitted to the seller's bank in their country or city, a process facilitated by secure electronic communication methods like SWIFT (in international trade) and SFMS (inland trade).

Advising the LC: Role of the Advising Bank

Upon receiving the LC, the seller's bank, known as the advising bank, authenticates the SWIFT message, ensuring the LC's legitimacy. The advising bank notifies the seller of the incoming LC, a step aptly termed advising. Notably, the advising bank may also serve as the collecting bank.

Seller's Actions and Process of Negotiation

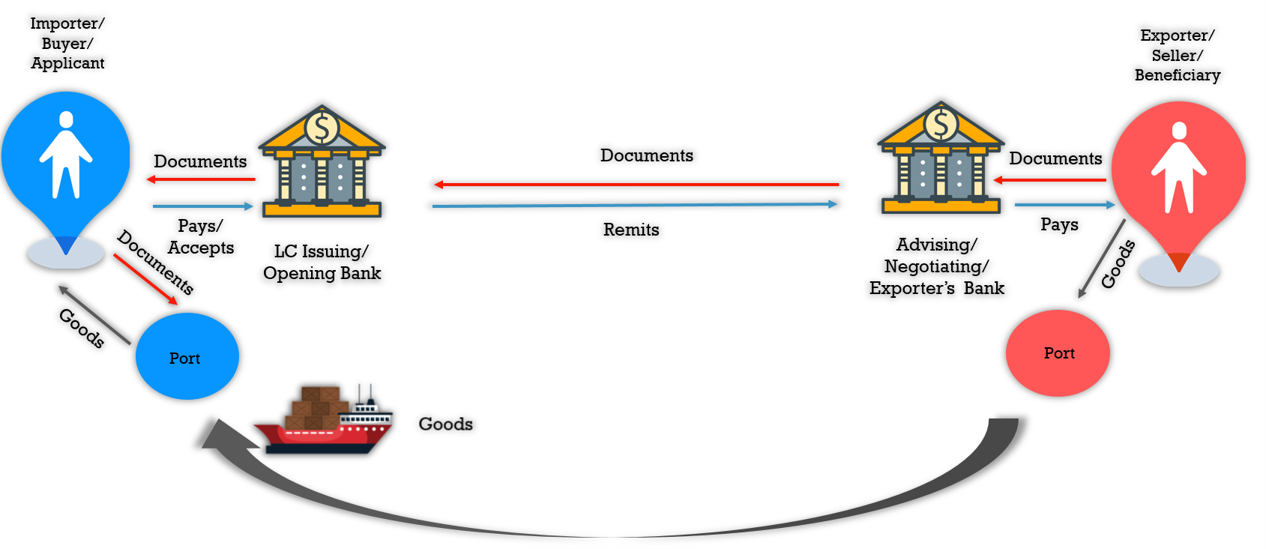

The seller collects the LC from the advising bank and assembles goods according to the LC instructions. Simultaneously, essential trade documents, such as invoices and certificates, are prepared. The seller then submits all documents to their bank, which acts as the negotiating bank. In cases where a nominated bank is specified in the LC, the negotiating bank is termed the nominated bank.

The negotiating bank reviews the documents against the LC conditions and, if compliant, advances the value of the goods to the seller—a process of advancing funds is known as negotiation (if the LC allows negotiation of documents)

Document Forwarding and Examination: Completing the Cycle

Next, the negotiating bank forwards the documents to the issuing bank. Meanwhile, assuming the goods have reached the buyer's location, the issuing bank scrutinizes the documents against the LC, to check for compliance. If found compliant, then in the case of a Sight LC, necessitating immediate payment, the buyer settles the payment to their bank. For a Usance LC, the buyer accepts the responsibility to pay at a later date, receiving the documents.

Lastly, the buyer presents the documents at the port and obtains the goods.

Settlement and Role of Additional Banks: Confirming and Reimbursing Banks

Upon receiving payment from the buyer, the issuing bank forwards it to the negotiating bank, completing the transaction cycle.

In international trade, two additional banks may play roles. A confirming bank provides an additional layer of assurance for the seller, guaranteeing payment if the issuing bank fails.

The reimbursing bank, often a branch of the issuing bank, handles transactions in the currency of the LC and reimburses the negotiating bank, streamlining the financial settlement process.

In essence, comprehending the intricate process of a Letter of Credit transaction is pivotal for participants in international trade, ensuring secure and transparent cross-border collaborations.

WANT TO READ MORE?

Already signed up/ logged in? Then you are all set!

Easy Explanation of International Trade Payment Methods like LC, Collections, BG etc and Incoterms 2020

TBML Typologies | Red Flags and Risk Indicators | Case Studies | AI/ML in combating TBML

Jump start your Trade Finance career with this 4-in-1 course package - Trade Finance Overview, Letter of Credit, Bank Guarantees and Incoterms® 2020