There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

The Article 2 of UCP 600 defines the terms 'Honour' when used in terms of a letter of credit transaction. Let's understand the actual meaning of the word by following the definition provided.

Article 2 defines 'Honour' as -

'Honour' means -

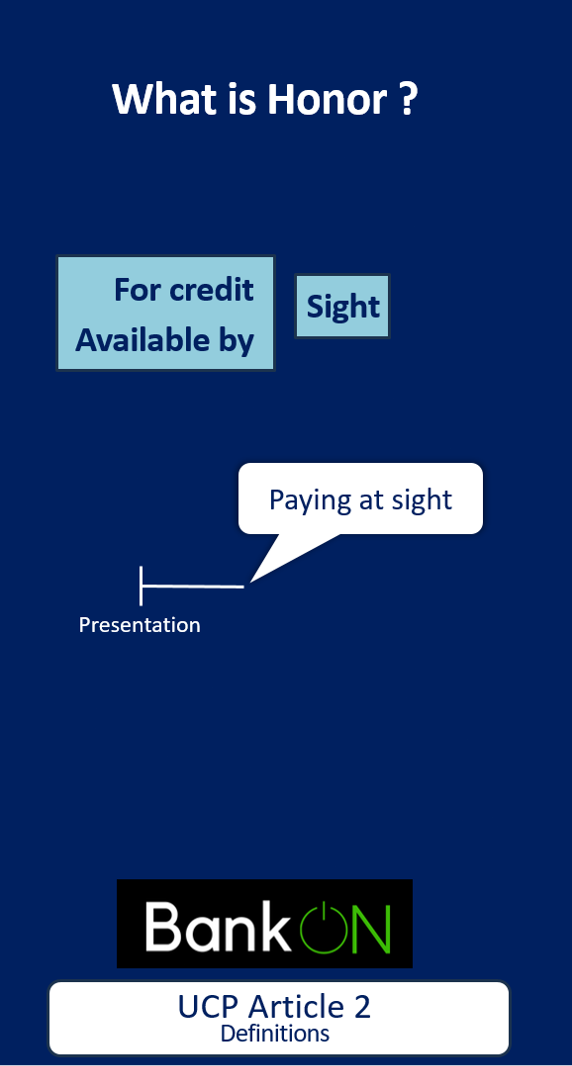

a. to pay at sight if the credit is available by sight payment.

Explanation -

When a credit is available by sight, on presentation of the documents under the LC, the documents must be checked for compliance. If found to be complying, then the payment must be done without further delay (Refer the above representation)

b. to incur a deferred payment undertaking and pay at maturity if the credit is available by deferred payment.

Explanation -

When a credit is available by deferred payment, on presentation of the documents under the LC, the documents must be checked for compliance. If found to be complying, then the bank undertakes to pay after a time period. No bill of exchange is involved in the undertaking. Finally, when the time period is over and the maturity date of the documents come, the bank must pay thus fulfilling its previous undertaking (Refer above representation).

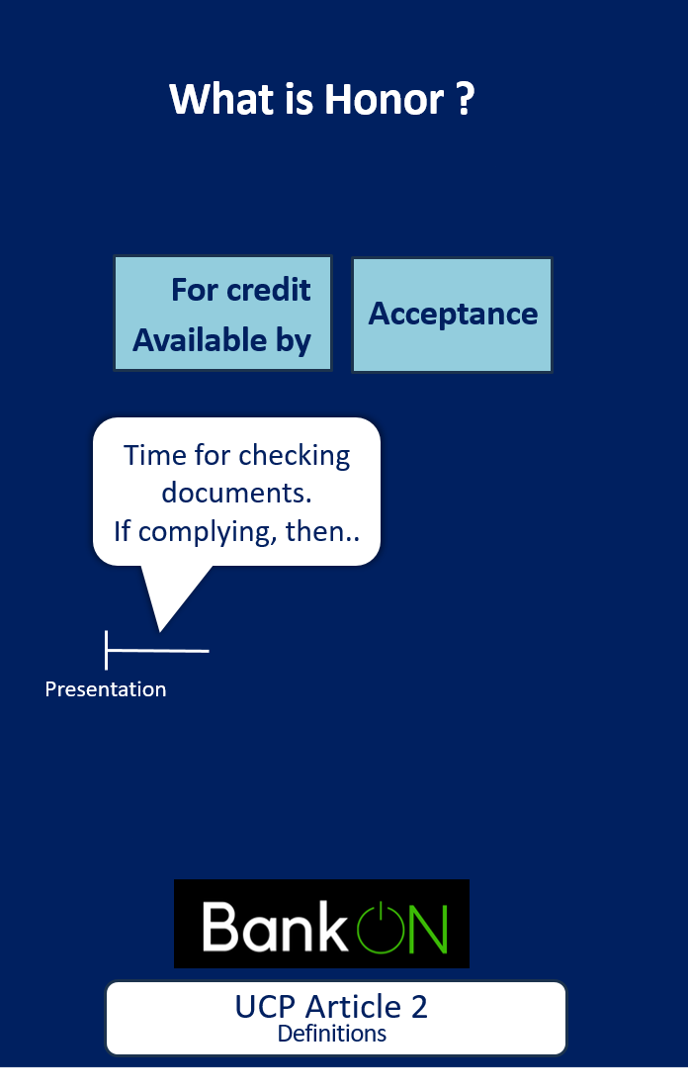

c. to accept a bill of exchange (“draft”) drawn by the beneficiary and pay at maturity if the credit is available by acceptance.

Explanation -

When a credit is available by acceptance, the entire process is same as 'deferred payment' explained as above, but the undertaking is provided on a bill of exchange (Refer above representation).

So, to put simply, just as in our daily life, 'honour' means 'to keep your word', in the context of a letter of credit too, it means keeping word and paying when promised. The bank which 'honours' the letter of credit may be the issuing bank, the confirming bank or the nominated bank, as and when the documents reach each bank during the lifecycle of the LC.

Want to learn more about International Trade Finance?

Discover all the essentials for a career in trade finance with this comprehensive 5-in-1 course package

View DetailsArticle 2 defines 'Negotiation' as -

"Negotiation means the purchase by the nominated bank of drafts (drawn on a bank other than the nominated bank) and/or documents under a complying presentation, by advancing or agreeing to advance funds to the beneficiary on or before the banking day on which reimbursement is due to (to be paid the nominated bank)."

Let us understand -

The documents under LC are first submitted to the nominated bank. The documents are then checked for compliance. After ascertaining compliance of the documents, if the nominated bank advances or agrees to advance the due payment to the beneficiary on or before the maturity date of the bill (i.e. paying the bill amount to the beneficiary before the actual maturity date of the bill), that act is called 'negotiation' of documents.

So, negotiation is basically an advance that the nominated bank gives the beneficiary on the basis of the letter of credit as the security.

WANT TO READ MORE?

Already signed up/ logged in? Then you are all set!

Easy Explanation of International Trade Payment Methods like LC, Collections, BG etc and Incoterms 2020

Types & Uses in International Trade | URDG 758 & ISP 98 - Main Points | Clauses & Examples | Related SWIFT Messages

Jump start your Trade Finance career with this 4-in-1 course package - Trade Finance Overview, Letter of Credit, Bank Guarantees and Incoterms® 2020