There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

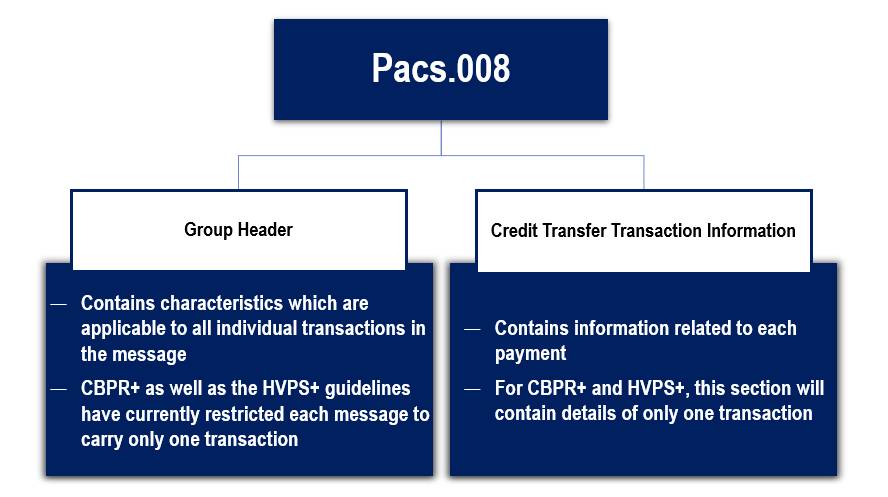

The Pacs.008 MX message is the FI to FI Customer Credit Transfer message. As the name suggests, this message is used by the banks when there is an underlying customer credit involved. This message is equivalent to the MT 103 ( Single Customer Credit Transfer) as well as the MT 102 ( Multiple Customer Credit Transfer) messages.

Let us go through the main points about the structure of the pacs.008 message -

Points to keep in mind about the pacs.008 Group header -

Let's group the elements of the credit transfer transaction information block depending on their purposes -

Five types of payment identification elements -

Three types of Amount elements -

'Charge Bearer' element (contains the division of charge), allowed values -

'Charges Information' element-

Agents (Elements related to various roles of banks in that payment) -

Parties (Elements related to various possible party roles in that payment) -

Accounts -

Instructions (Miscellaneous information that one bank passes to another)-

Remittance related (Elements that give details about the payment, e.g, Invoice details) -

This is in brief the structure and elements of a pacs.008 message. For structures of other MX messages keep reading the next articles.

WANT TO READ MORE?

Already signed up/ logged in? Then you are all set!

Basics of Payments | SWIFT MT/ MX Payment Message Types with examples | SWIFT GPI

CBPR+ Usage Guidelines | XML and Messages Schema | Messages Structure | MX Messages Examples

The Ultimate No-Nonsense Guide to SWIFT MT and ISO 20022 MX Message Types