There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

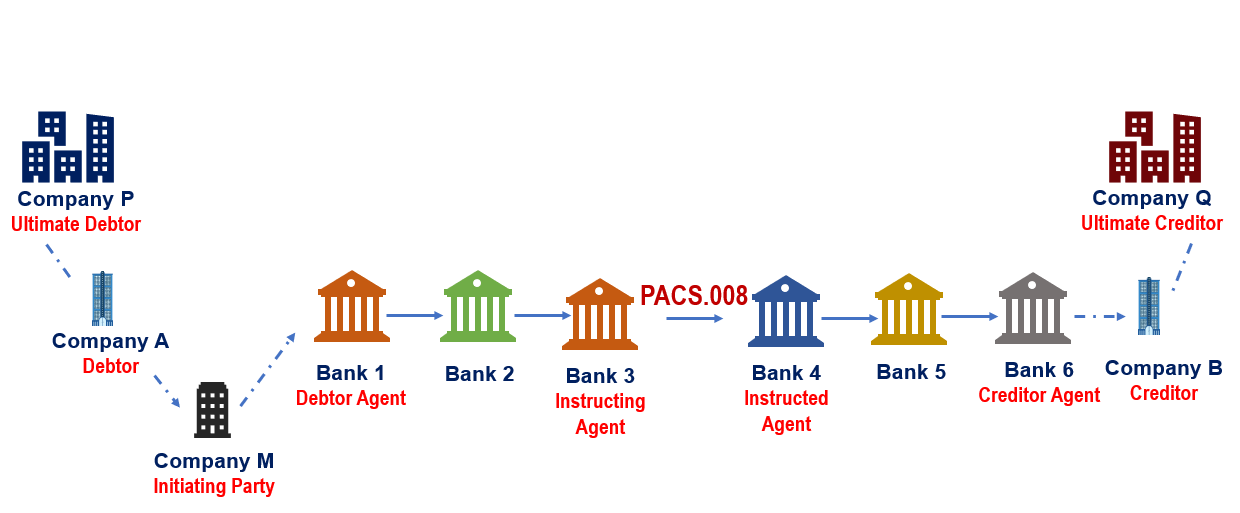

On-Behalf-Of (OBO) transactions may be of two kinds.

OBO payment is where a customer is making a payment on behalf of another. OBO collection is where a customer is receiving a payment on behalf of another.

A simple example of an OBO payment may be your parent paying your loan EMI on behalf of you. But when such OBO transactions happen in case of big corporates, the implications from due diligence and regulatory angle are very significant.

OBO transactions are used increasingly by corporates due to various reasons - business models, ease of accounting etc. Hence, there was a dire need to address this gap in the current MT messages. The solution to this was the newly added roles in the ISO 20022 MX messages aimed to provide as much transparency to the payment chain as possible.

Ultimate debtor - Ultimate party that actually owes an amount of money

Ultimate creditor - Ultimate party that actually supposed to be paid

Initiating party - Party that initiates the payment on behalf of the debtor or creditor

Source: PMPG Whitepaper - November 2023

Ultimate debtor in relation to trust transactions- A buyer wishes to purchase a house from the seller and deposits the funds into a trust account held with a law firm. Once the deal is settled. the law firm acts on the buyer's behalf and initiates a payment, using its own account. In this case, the buyer is the ultimate debtor and the law firm is the debtor.

Source: PMPG Whitepaper - November 2023

Ultimate debtor in relation to parent and subsidiary companies- A corporate buyer company wants to pay its seller. The payment is handled by the parent company of which this buyer company is a subsidiary. In this case, the parent company is the debtor, as it is the one who is making the payment on the behalf of its subsidiary. The buyer company is the ultimate debtor.

Source: PMPG Whitepaper - November 2023

Initiating Party- A corporate has authorized a payroll management company to make regular salary payments to its employees. The payroll management company requests the bank holding the corporate's account to make the monthly payment. So, it is the initiating party.

Note that in case of a initiating party, that party is only handling the initiation or payment request, the account getting handled is always that of the debtor's. So, the initiating party is just providing an account handling service.

But, in case of ultimate debtor - debtor scenario, instead of the account of the ultimate debtor, it is the debtor's account which is getting debited, hence here the concept is 'on - behalf - of' transaction.

Thus, whenever in a payment, an ultimate debtor, an ultimate creditor or an initiating party will be present, it will be clearly mentioned in the MX payment message unlike MT messages, and thus it will be easier for banks to perform due diligence and banks can take informed decision in processing payments.

WANT TO READ MORE?

Already signed up/ logged in? Then you are all set!

Basics of Payments | SWIFT MT/ MX Payment Message Types with examples | SWIFT GPI

CBPR+ Usage Guidelines | XML and Messages Schema | Messages Structure | MX Messages Examples

The Ultimate No-Nonsense Guide to SWIFT MT and ISO 20022 MX Message Types