There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Document examination under a letter of credit has been a manual process for a long time. It is time consuming, error prone and cumbersome to keep in mind all the applicable rules while scrutinising the documents. But, times are changing. In the age of automation, innovative latest technologies are ready to drastically upgrade the way documents under letters of credit are handled. But what does this really mean? Let's get an overview -

Digitisation of Documents

The first step is digitisation of documents. It means converting a paper document to a digital form. We do this very commonly in our day to day life - scanning of documents. In professional document imaging there are additional options of high definition digital images, storing of such images in secured digital repositories to be accessed on demand etc.

This small step gives the advantage of scrutinising the digital images instead of the paper documents which implies that the scrutiny can be done from anywhere, a vital requirement of business continuity plans for banks in the post-covid era.

Document imaging alone can hardly automate the scrutiny process as the rest of the process of examining the document contents is still a manual job. The next possible step of improvement is using OCR and RPA.

Want to learn more about International Trade Finance?

Discover all the essentials for a career in trade finance with this comprehensive 5-in-1 course package

OCR stands for Optical Character Recognition. What does it do? We all know that when a paper document is scanned to a digital image, the texts and contents of the paper are not recognisable by the computer. It cannot understand each word separately and the whole page is regarded as a single entity - an image. But to automate document examination, the computer must understand the contents of the scanned paper. OCR acts as the first help to that. OCR technology can recognize the words from the scanned images and thus extract the vital information that the paper contains.

Optical Character Recognition

RPA stands for Robotic Process Automation. It is a software technology that can mimic human actions interacting with digital systems and software. You can imagine this as bots that can use the data extracted with the help of OCR for further processing. It can do repetitive data entry, feeding the data in ERP systems etc.

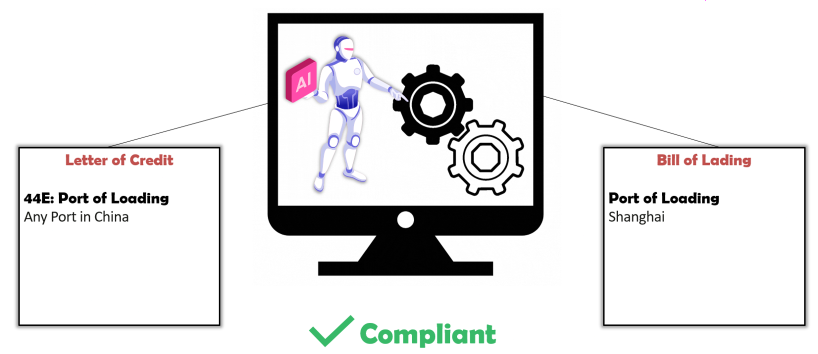

By using OCR and RPA together, the extraction of party names, countries, ports, dates, amounts, currencies from the document image can be done. Simple and literal checking like whether applicant & beneficiary details in invoice literally match with that of LC or not, whether names of ports in documents match with that of LC or not, can be automated. But a human should be actively involved in all steps of the digitisation and document examination process.

But it cannot comprehend complicated instructions in a LC. Here comes the role of NLP (Natural Language Processing) and Machine Learning which is level 3.

NLP is the ability of a computer program to understand human language as it is spoken and written - referred to as natural language. It is a component of artificial intelligence. It can comprehend non-literal, complex sentences to understand its true meaning.

Machine Learning on the other hand is a way a computer program can imitate the way humans learn. It can self-teach itself and gradually improve its accuracy based on the error feedback received.

Partial Automation using Machine Learning and NLP

By combining NLP and machine learning, non-literal comparisons required in document scrutiny like inferring the following can be done -

This process is largely automated and supervised by a human. Only certain critical parts of the document examination process are manually executed.

Deep learning is an advanced form of machine learning. Classical, or "non-deep", machine learning is more dependent on human intervention to learn. On the other hand, deep learning can ingest unstructured data in its raw form (e.g. text, images), and it can automatically determine the set of features which distinguish different categories of data from one another. Unlike machine learning, it doesn't require human intervention to process data.

Using deep learning along with other advanced AI technologies even complex inferences required in LC document scrutiny can be automated. For example -

In high level automation the entire process is automated, and a human is only involved to handle exceptions when requested to intervene by the system.

These technologies will result in drastic reduction of document handling time and human errors and experienced document checkers can concentrate on where they are needed the most, i.e. handling potential discrepancies based on system feedback rather than needing to go through the full checking process and all the submitted documents. As the automation processes continue to evolve, efficient utilisation and adoption of it in trade finance is going to be a game changer for banks and customers alike in the future.

WANT TO READ MORE?

Already signed up/ logged in? Then you are all set!

Easy Explanation of International Trade Payment Methods like LC, Collections, BG etc and Incoterms 2020

Types & Uses in International Trade | URDG 758 & ISP 98 - Main Points | Clauses & Examples | Related SWIFT Messages

Jump start your Trade Finance career with this 4-in-1 course package - Trade Finance Overview, Letter of Credit, Bank Guarantees and Incoterms® 2020